Wall Street retreated from its records on Tuesday as Nvidia and other chip stocks saw major drops and oil prices slid.

S&P 500 Futures: 5,815.26 ⬇️ down 0.76%

S&P 500: 5,815.26 ⬇️ down 0.76%

Nasdaq Composite: 18,315.59 ⬇️ down 1.01%

Dow Jones Industrial Average: 42,740.42 ⬇️ down 0.75%

STOXX Europe 600: 520.57 ⬇️ down 0.80%

FTSE 100: 8,249.28 ⬇️ down 0.52%

CSI 300: 3,855.99 ⬇️ down 2.66%

Nikkei 225: 39,910.55 ⬆️ up 0.77%

Bitcoin: $66,744.19 ⬆️ up 1.07%

U.S.: Wall Street loses record rally as tech stocks tumble

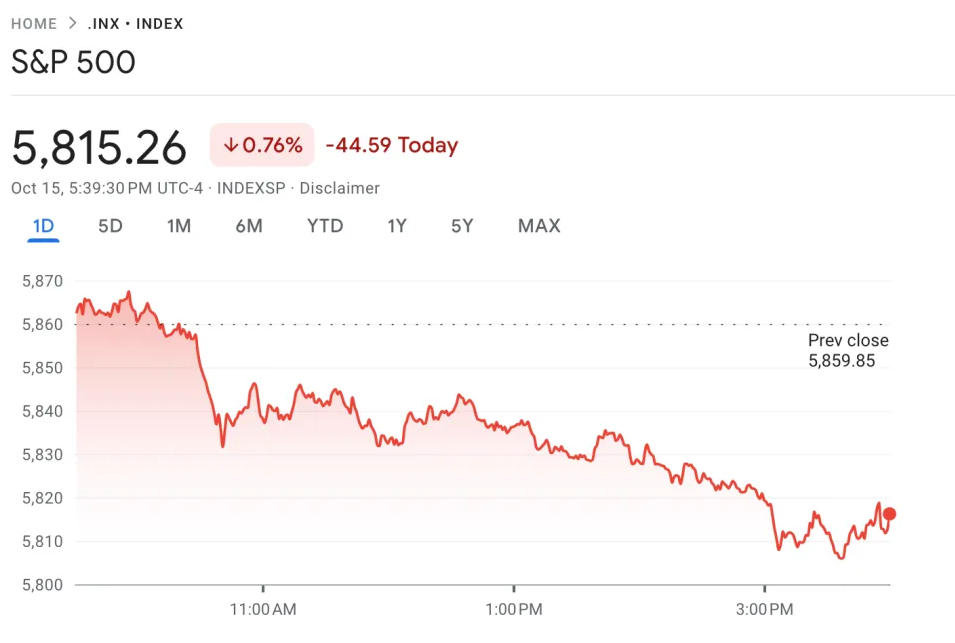

Tech drops impacted Wall Street Tuesday, with Nvidia weighting down the S&P 500 as it plummeted 4.5%. Chip stocks across the board also took a hit after Dutch supplier ASML released its quarterly results, with U.S.-listed shares plunging 16.3%. The S&P 500 closed down 0.76%, the Dow closed down 0.75% and the Nasdaq took the heaviest hit, closing down 1.01%

Europe: Shares close down as oil prices drop

European stocks hovered around breakeven early in the day but markets closed mostly down Tuesday as oil prices and tech stocks dropped. The Stoxx 600 index closed down 0.80%, with most major markets finishing in negative territory. Across European sectors, performance was mixed. Media stocks gained 1.46%, while oil and gas stocks fell 3.24%, following declines in the oil market.

China: Shares drop with weak export numbers

Chinese stocks declined as investors reacted to the absence of any new substantial stimulus measures, coupled with disappointing export data. Exports grew just 2.4% year-over-year in September, significantly below the anticipated 6%, according to figures released late Monday. The CSI 300 index, which represents the 300 largest companies on the Shanghai and Shenzhen exchanges, dropped 2.66%, while Hong Kong’s Hang Seng index fell 3.67%.

Japan: Nvidia pulls up semiconductor shares

The Nikkei 225 climbed 0.77%, briefly reaching a three-month high, driven by gains in technology and financial stocks. Nvidia’s strong performance lifted semiconductor-related companies such as Tokyo Electron and Advantest, which saw increases of 4.49% and 3.37% respectively. Softbank, the majority owner of chip giant Arm Holdings, surged 5.76%. Additionally, the weak yen, which benefits Japanese exporters, provided further support to Nikkei stocks.