Recently, it was reported that a user on the XCH platform faced a devastating situation where, after making substantial profits, he was unable to close his position, leading to the complete liquidation of his account. Despite numerous attempts to close the position, the user was unsuccessful. At a critical moment, he found himself helpless, unable to exit the trade, and was forced to watch as his account, which was in profit, plunged into a negative balance, leaving him with a debt of over $3,000 to the platform.

Inability to Close Position Results in Account Liquidation

According to the user, he began trading on the XCH platform in early April, with an initial deposit of $50,000. By the time of the incident, the account had grown to over $150,000. On May 2, 2024, around 7 a.m., the user noticed an unfavorable trend in the BTCUSD market and attempted to close his position. However, despite repeatedly clicking “close position,” there was no response from the platform. The user could only watch as the losses mounted, ultimately resulting in the system forcibly closing the position. This single trade resulted in a total loss exceeding $150,000, wiping out both the profits and the original deposit, and leaving him with a negative balance of $3,230.

The user has since lodged multiple complaints with the XCH platform, arguing that a platform disconnection prevented him from closing the position and seeking compensation for the negative balance and losses. However, the platform has dismissed his complaints, insisting that the losses were due to user error. The user pointed out that one of XCH’s claimed advantages is an “automatic margin closeout system to minimize significant losses to client principal.” Yet, despite this, his account ended up with a negative balance of $3,230. Now, more than four months later, the user’s complaints remain unresolved, and he is unable to access his account.

About the XCH Platform

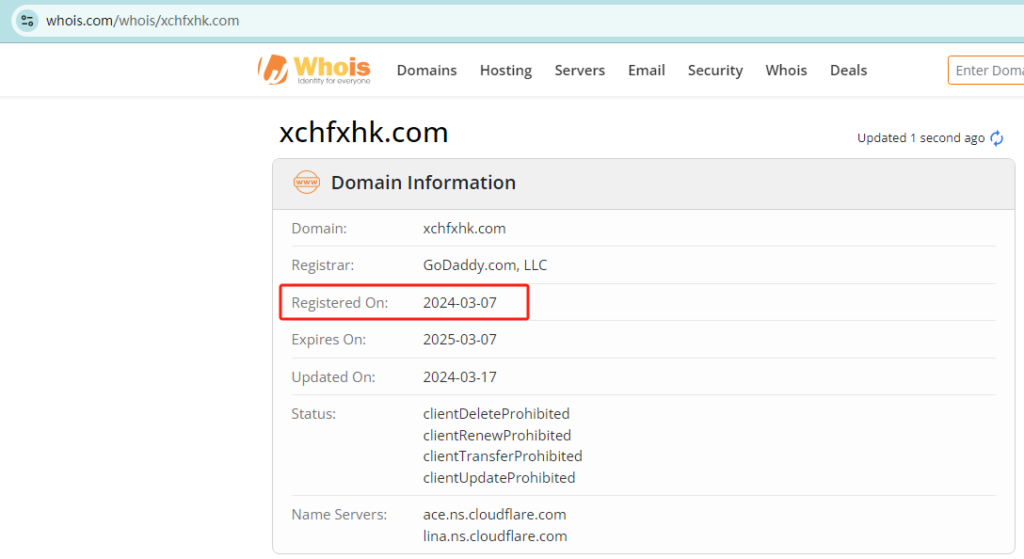

The XCH platform, accessible at www.xchfxhk.com, was registered on March 7, 2024, indicating it has been in operation for only a short period.

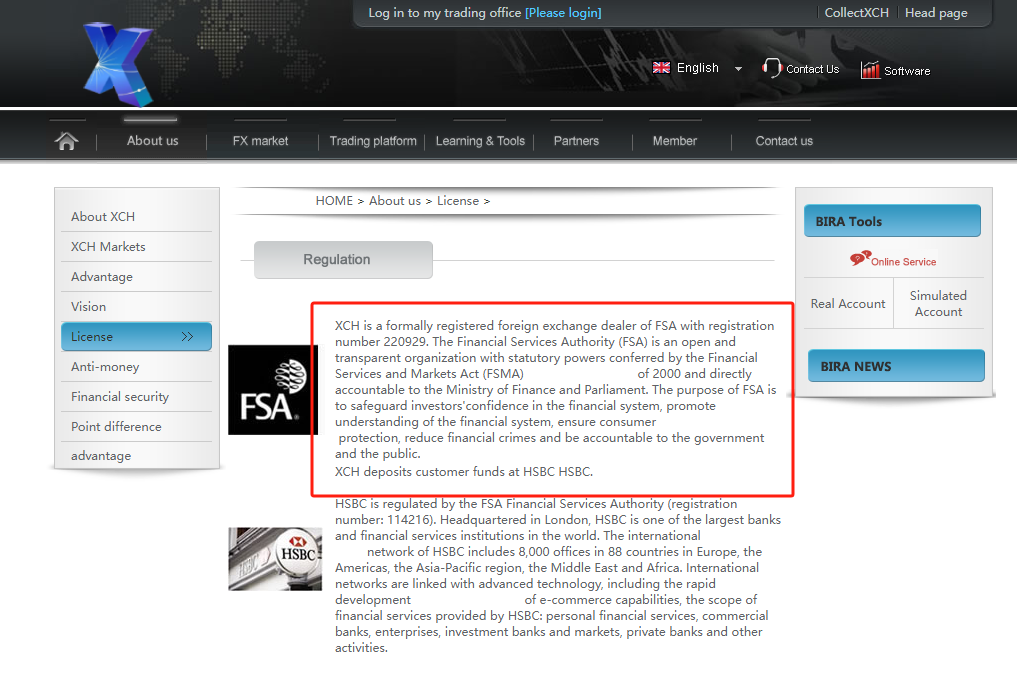

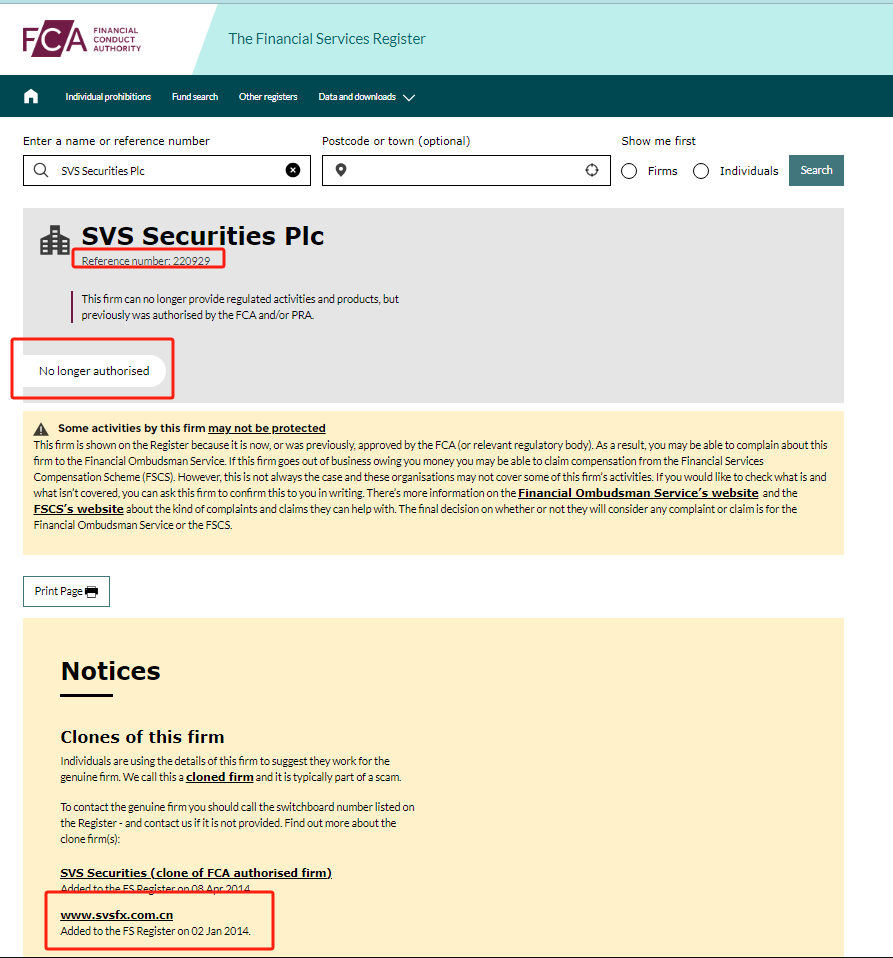

The platform claims to offer forex, precious metals, and other trading services and alleges that it is a legitimately registered forex broker under the UK Financial Services Authority (FSA) with registration number 220929.

However, it’s important to note that the FSA has long been rebranded as the UK Financial Conduct Authority (FCA). A check with the FCA reveals that this registration number actually corresponds to SVS Securities Plc, whose registered website is www.svssecurities.com, completely unrelated to XCH. Moreover, the license was revoked on August 31, 2023. This clearly indicates that XCH is fraudulently claiming regulatory status, using a revoked license to appear legitimate. Attempting to reason with such a dishonest platform is likely to be an exercise in futility.

FXDaily24 Alert

In forex trading, situations where closing a position is not possible do occur, often due to insufficient liquidity or network delays. Besides being mindful of these issues, the safest approach is to set stop-loss orders. The significance of stop-loss orders cannot be overstated—they are crucial for managing risk. Without them, risks can spiral out of control, leading to unforeseen losses.

Moreover, selecting a reliable platform is paramount. The forex market is flooded with questionable entities, so investors must exercise extreme caution. It is essential to thoroughly research a broker’s credentials before making any deposits.