Swedish authorities label certain cryptocurrency exchanges as key enablers of organized crime, highlighting four distinct money-laundering profiles.

The Swedish Police Authority and the Financial Intelligence Unit (FIU) have classified cryptocurrency exchanges as “professional money launderers (PML)” following an analysis of services provided by unlicensed and illegal providers.

According to the FIU, PMLs have criminal links and enable several individuals and criminal networks to systematically launder money.

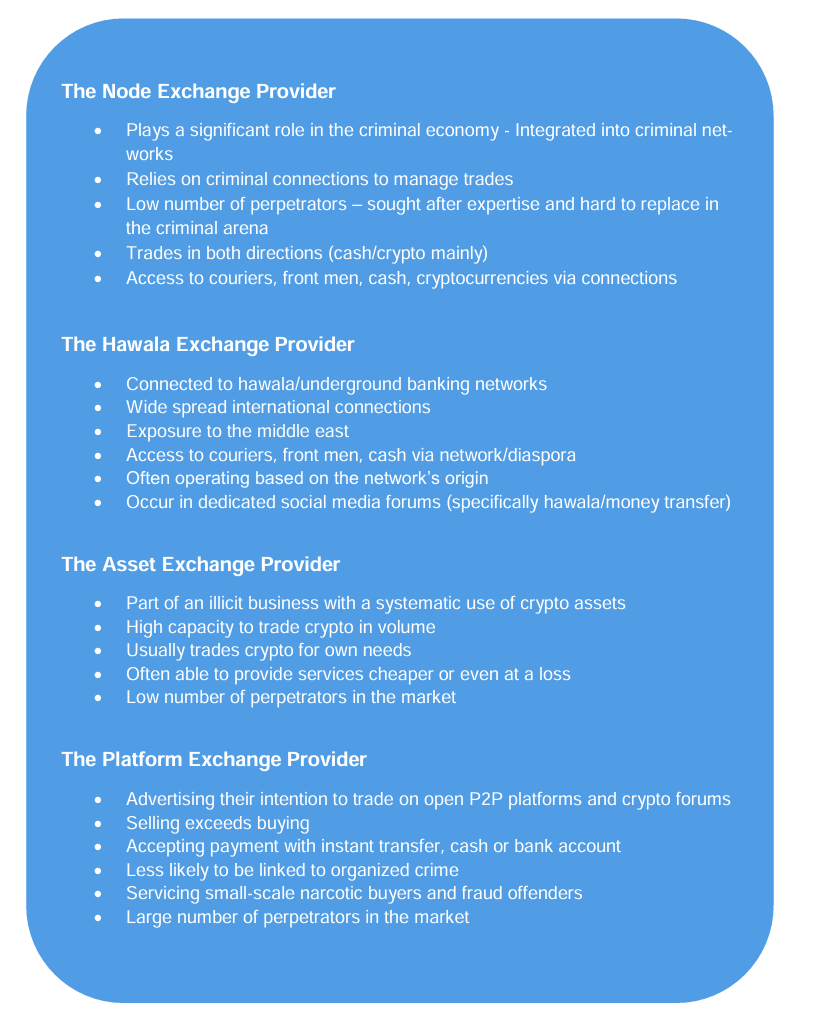

Based on their analysis of underlying characteristics, the FIU categorized PMLs into four profiles: the node exchange provider, the hawala exchange provider, the asset exchange provider and the platform exchange provider.

Four profiles of professional money launderers or illegal cryptocurrency exchanges by FIU Sweden. Source: Swedish Police Authority

Plans for monitoring crypto exchange services

The report called for law enforcement’s greater involvement and presence on crypto trading platforms to curb illegal services, adding:

“FIU Sweden assesses illicit cryptocurrency providers as an emerging threat within money laundering schemes and a crucial part for organized crime to maintain and expand their criminal markets.”

On the other hand, the Swedish authorities acknowledged the role of licensed and legitimate crypto trading platforms, without criminal intent, in curbing money laundering activities. It urged such entities to observe suspicious trading patterns of its users and take necessary actions, including stopping transactions and offboarding clients.

Sweden’s ongoing crackdown on illegal cryptocurrency-related activities recently targeted the nation’s Bitcoin mining community.

Sweden collects unpaid taxes from Bitcoin miners

The Swedish Tax Agency investigated the operations of 21 crypto-mining firms between 2020 and 2023 and identified several ambiguities in their tax filings.

The investigation revealed that 18 crypto-mining firms filed “misleading or incomplete” information to avoid paying value-added tax on taxable operations. The agency stated that “the described approach leads to tax disappearing from the country in the form of incorrect payments of input VAT, unpaid output VAT and unreported crypto assets.”

The crypto mining firms appealed against the $90 million tax demand to the administrative court. Out of the lot, appeals of two mining firms were accepted, and the court said that “the amounts above have been adjusted with regard to the verdicts.”