CNBC’s Jim Cramer on Wednesday said charts indicate that the bull market can roar higher if the tech sector continues to perform, especially the stock of Nvidia, a leader on the indexes.

“The charts, as interpreted by Jessica Inskip, are looking pretty darn good for the S&P and the Nasdaq-100, and of course, yes, Nvidia,” he said. “We’ve got a much broader bull market than we had six months ago, but if it’s going to keep running, Inskip says we need to see some meaningful participation from tech.”

While tech may not have to “lead the way anymore,” it still has to “at least follow the leaders,” Cramer said. The sector shouldn’t behave as it did on Tuesday, he added, when the semiconductor stocks faltered after a poor earnings report from ASML that knocked more $50 billion from the chip company’s market cap.

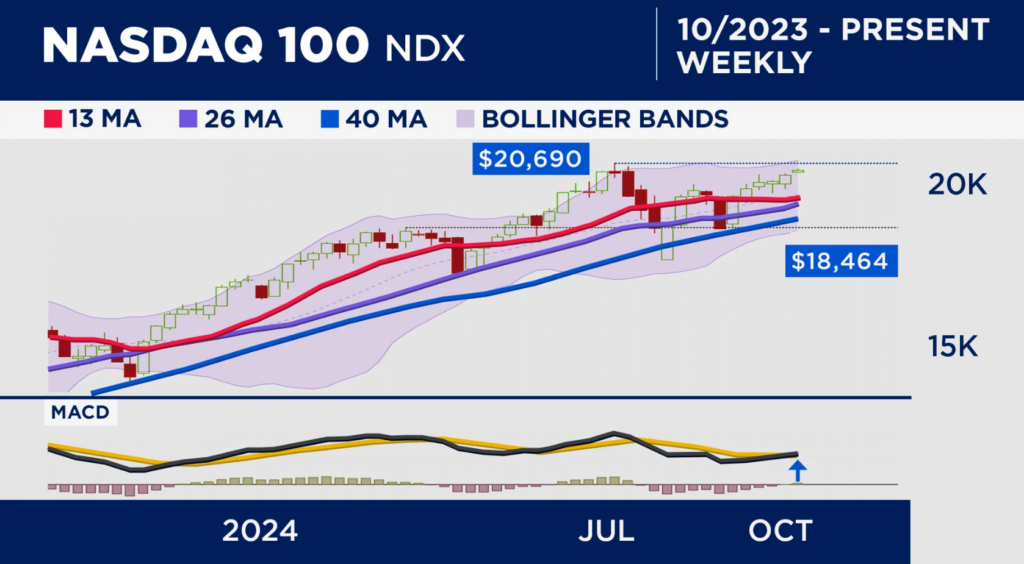

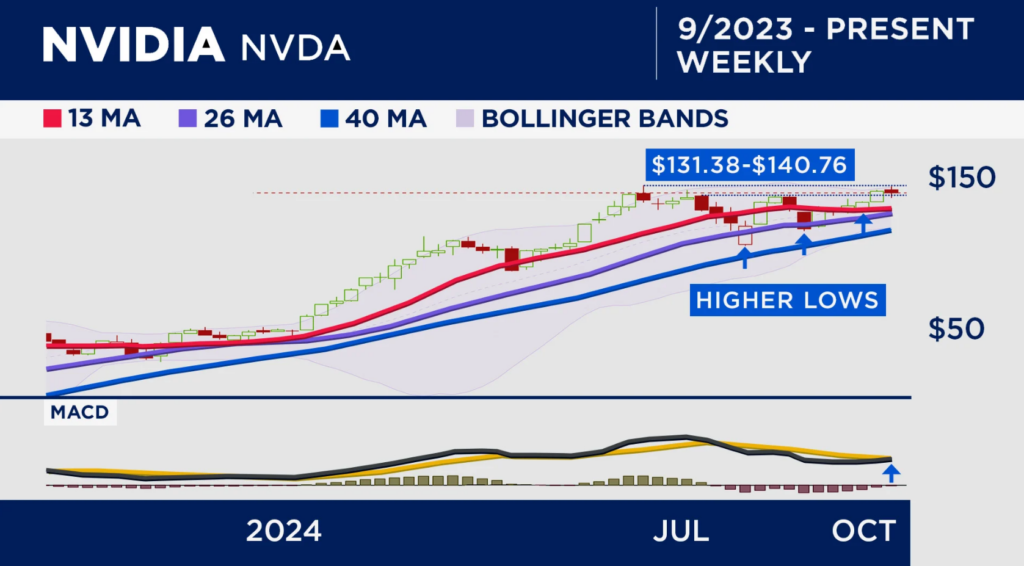

To explain analysis from Inskip, Cramer examined charts of both Nvidia’s and the Nasdaq 100′s weekly performance since last fall.

According to Inskip, the Nadaq 100 — which includes some of the market’s largest tech stocks — remains in a bullish trading cycle, but hasn’t been hitting higher highs like the S&P 500. The index is headed in the right direction, Inskip said, but needs to break through its highs from July in order to help the market rally.

Similarly, Cramer said, Inskip sees a bullish background when it comes to the stock of Nvidia. Cramer said the stock is in a “bullish consolidation pattern,” processing its gains over the last few years before it heads higher. Inskip said she sees an upside if Nvidia’s price can break out above $140.

“She thinks Nvidia’s the most important stock in the market — if it can make a higher high, she thinks that’s the whole ballgame,” he said. “As for me? I never bet against the fabulous Jensen Huang.”