BNB is way below its all-time high when charted against Bitcoin, but that could soon change.

BNB has been in focus recently as Binance founder and former CEO Changpeng “CZ” Zhao walked out of a United States federal prison on Sept. 27 after serving a four-month stint for Anti-Money Laundering violations.

While some believe that CZ’s release could trigger a rally in BNB, others expect the performance to mirror that of the broader altcoin market.

BNB, similar to Bitcoin, has been stuck inside a large range for several months, indicating indecision between the bulls and the bears.

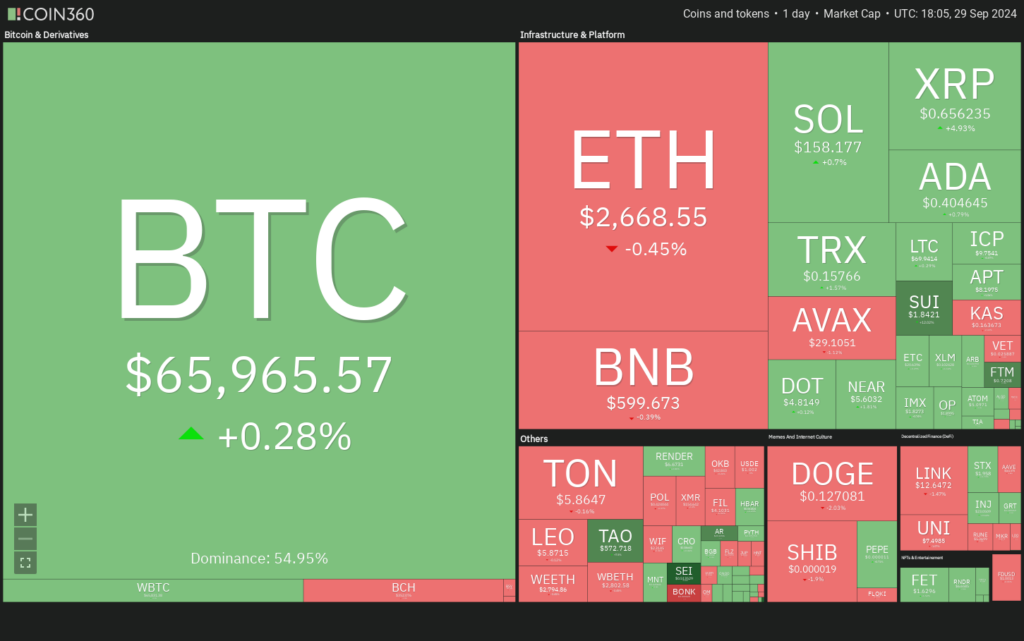

Crypto market data daily view. Source: Coin360

However, a positive sign is that investors are bullish on the long-term prospects of both Bitcoin and BNB. Some analysts expect Bitcoin to hit a new all-time high in the fourth quarter, while others anticipate a new high in 2025. For BNB, a few analysts anticipate a rally to as high as $1,000.

The big question is which among Bitcoin and BNB could be an outperformer? Will BNB, which is way below its all-time high in terms of Bitcoin, make a comeback? Let’s analyze the BNB/BTC charts to find out.

BNB/BTC weekly price analysis

The pair is trying to pull back in a downtrend, but the recovery is facing selling just below the 38.2% Fibonacci retracement level of 0.010 BTC. This suggests that the sentiment remains negative, and traders are selling on rallies.

BNB/BTC weekly chart. Source: TradingView

If the price continues lower and breaks below the 20-week simple moving average (0.009 BTC), the BNB/BTC pair could reach the 50-week simple moving average (0.008 BTC). This level is likely to attract buyers, which could keep the pair stuck between the 50-week SMA and 0.010 BTC for some time.

Contrarily, if the price rebounds off the 20-week EMA, it will suggest that bulls are buying on dips. The bulls will then make an attempt to clear the overhead hurdle at 0.010 BTC. If they succeed, the pair could move to the 50% Fibonacci retracement level of 0.012 BTC and after that to the 61.8% retracement level of 0.014 BTC. Buyers will have to overcome this barrier to suggest that the downtrend has ended.

BNB/BTC daily price analysis

The pair has been trading inside a wide range between 0.008 BTC and 0.010 BTC for several months. Both moving averages are crisscrossing each other, and the relative strength index (RSI) is just below the midpoint, indicating a balance between supply and demand.

BNB/BTC daily chart. Source: TradingView

If the price breaks below the 50-day SMA (0.009 BTC), the pair could slump to 0.0086 BTC. This is an important level for the bulls to defend because a drop below it may sink the pair to the bottom of the range at 0.008 BTC.

On the upside, the first resistance is at 0.0097 BTC. If this level is cleared, the pair could retest the crucial level of 0.010 BTC. A sharp reversal from 0.010 BTC will suggest that the range-bound action may remain intact, while a breakout could start a new up move. The break from the range gives the pair a target objective of 0.012 BTC.