SEC Chair Gary Gensler has taken heat from lawmakers and members of his own agency during a House Financial Services Committee hearing over his handling of crypto regulation in the United States.

United States Congressman Tom Emmer slammed SEC Chair Gary Gensler as the most “destructive” and “lawless” Chair in the regulator’s 90-year history, calling him out for making up the term “crypto asset security” without ever providing any regulatory guidance for digital assets.

“You’ve made up the term crypto asset security. This term is nowhere to be found in statute, you made it up [and] you never provided any interpretive guidance on how crypto asset security might be defined within the walls of your SEC,” Emmer told Gensler before a House Financial Services Committee hearing on Sept. 24.

Emmer said the term had served as the entire basis for Gensler’s “enforcement crusade” against the crypto industry for the last three years. This was up until last week when SEC lawyers retracted the term in a court footnote.

“Your inconsistencies on this issue have set this country back. We could not have had a more historically destructive or lawless chairman of the SEC.”

Emmer also grilled Gensler over his agencies’ handling of the Debt Box case — a case where the SEC sued a crypto startup for an alleged $50 million fraud scheme. The case against Debt Box was dismissed on May 28, and the SEC was ordered to pay $1.8 million in fees.

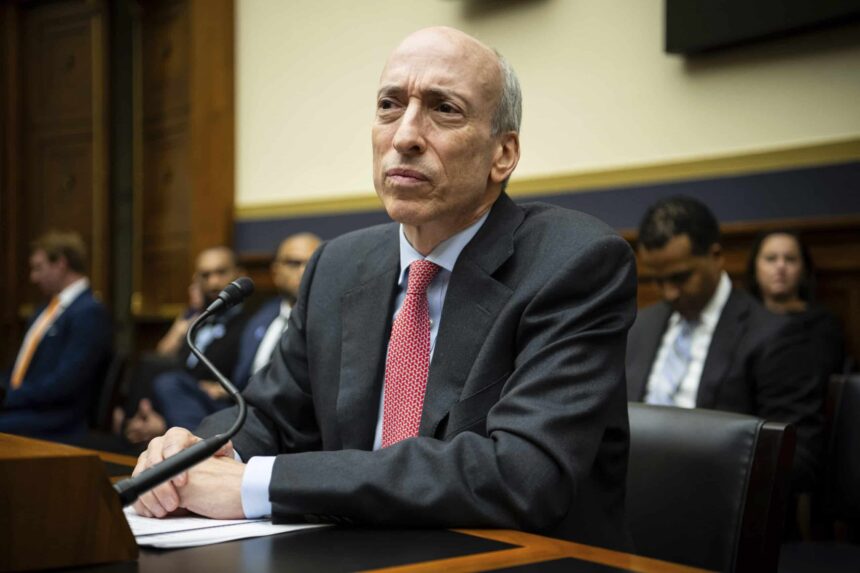

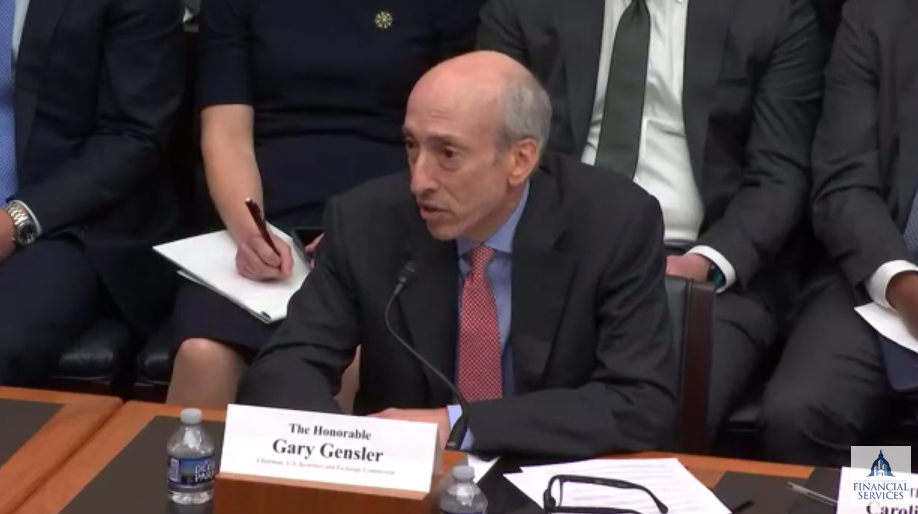

SEC Chair Gary Gensler speaking at the Congressional hearing. Source: US House Financial Services Committee

Emmer said the SEC attorneys crafted a series of lies in the Debt Box case to “effectuate the commands” of Gensler’s “anti-crypto rhetoric” and regulation-by-enforcement agenda.

“The matters in that case were not well handled,” Gensler said in response to Emmer’s questioning.

SEC ‘should have admitted long ago’ that crypto tokens aren’t securities: Peirce

Gensler also faced heat from within his own ranks, with SEC Commissioner Hester Peirce saying the SEC’s move to retract the term crypto asset security in court last week should have happened “a long time ago.”

“[By] tucking into a footnote, we admit that now actually the token itself is not a security. That’s something that we should have admitted long ago,” the pro-crypto SEC commissioner explained.

“We’ve fallen on our duty as a regulator not to be precise,” Peirce said.

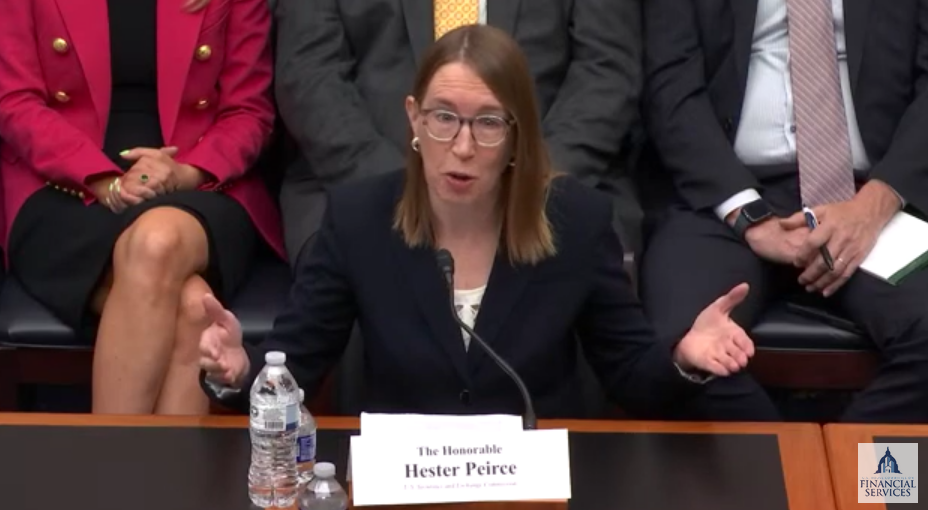

Peirce responding to House Financial Services Committee chairman Chair Patrick McHenry at the hearing. Source: US House Financial Services Committee

When asked whether crypto tokens need a statutory definition to ascertain how they apply to securities laws, Peirce responded: “It’s always helpful to have Congress weigh in but there certainly are some guidelines we could provide in this area that we have chosen not to provide.”

“But a statutory definition would help well I always welcome the input of Congress.”

Gensler confirms SAB 121 rule will stay in place

Despite calls from 42 US politicians to rescind the SEC’s Staff Accounting Bulletin No. 121 rule, Gensler said it will remain in effect.

“No, it’s a good accounting bulletin,” Gensler said in response to a question from House Rep. Wiley Nickel about whether the SEC would rescind the rule.

The SAB 121 rule mandates SEC-reporting entities that custody crypto to record those holdings as liabilities on their balance sheets. A SAB 121 repeal bill received bipartisan support in Congress before being vetoed by President Joe Biden in June.

Gensler claims it will help public companies understand the risks associated with holding crypto, pointing to FTX, Terraform Labs and other crypto bankruptcies.

Nickel didn’t bite, claiming that SAB 121 actually makes the digital asset ecosystem “less safe.”

Nickel recently claimed that SAB 121 would prevent US banks from custodying crypto exchange-traded products at scale, creating a “concentration risk” by handing more control over to non-bank entities.

With the rule now in place, Nickel slammed the SEC’s Office of the Chief Accountant for recently exempting Bank of New York Mellon from the balence sheet reporting requirement — arguing that it will lead to “different rules for different folks.”

But Gensler didn’t agree: “It’s actually the same rules for different folks.”